What is Probate?

Probate is the legal process that allows a person’s stuff to transfer to their family or loved ones after they die.

The probate process operates through the courts in Pennsylvania. A person is appointed as the estate’s representative and is empowered to manage the person’s assets, debts, and other affairs (their estate). This person is then obligated to gather all of the person’s assets, pay their final expenses and debts, pay the estate and Pennsylvania inheritance taxes, and distribute remaining assets to the person’s family or beneficiaries.

Estate Administration Services

There are dozens of tasks involved in the estate administration process. We can help you along the way and share some of the burden that comes with being named as an executor. Everything from completing and filing forms with the County and State, to drafting and filing the Inheritance Tax Return and preparing an accounting for the beneficiaries.

Trust Administration

Named as Trustee over someone else’s trust? Our firm can represent you as the trustee and make sure you manage the trust properly and protect you from any potential liability.

For more information on potential risks when acting as trustee, check out our blog posts.

Inheritance Tax Return Preparation

If you’ve already started the probate process and need assistance with filing the inheritance tax return and closing out the estate, our firm is well equipped to step in and help you wrap up the probate process.

Unclaimed Property

Have you run an unclaimed property search? Finding unclaimed property is an often overlooked step in the estate administration process. We can help you run the search and claim any unclaimed property.

We Are Here to Help

If you have questions about the probate process or about estate or trust administration, call our office to schedule a free consultation with one of our attorneys.

Understanding Probate

Estate Administration Process

The Estate Administration Process Covers a Wide Range of Tasks, Including:

- Validating the person’s Will

- Locating and gathering assets

- Selling assets

- Paying debts

- Communicating with heirs and beneficiaries

- Paying inheritance and estate taxes

- Accounting for all estate assets and expenses

- Distributing funds to the beneficiaries

- How to Avoid Probate?

Who Gets a Person’s Stuff After They Die?

Who gets your property after you die in Pennsylvania? There are two main ways that will determine how a person’s assets are distributed after they die:

- A will (or trust), signed by the individual before they die which will name an executor and list the people who will inherit there property and in what amounts.

- Through Pennsylvania intestacy laws. Each state has enacted an intestate succession law to address this issue. These laws are essentially a default estate plan for people who don’t create their own. If there is no Will, these laws will determine how all of the deceased’s probate property will be distributed. Here is a link to Pennsylvania’s Intestacy statute for reference.

To answer the question “who will get a person’s stuff after they die?” We have to first determine if that person had a will, and then determine which family members survived them.

The Pennsylvania Estates and Fiduciaries Code (the statute that governs estates) can be very complicated when it comes to determining who will inherit what after an individual dies. Reviewing the facts with an estate administration lawyer near Harrisburg, PA will help determine the heirs so that the administrator can properly distribute the assets.

How to Avoid Probate in Pennsylvania

How long probate takes depends on the size and complexity of the estate, but generally an estate should take somewhere between 12 and 18 months from start to finish. It is not uncommon for an estate to take as long as two years. Selling real estate or dealing with a small business can take quite a long time.

The Pennsylvania Department of Revenue can take up to six months to process the inheritance tax return which can add to the delay in closing the estate. Final debts and expenses can usually be paid quickly as long as there is some cash available, and beneficiaries can be given partial distributions so they do not have to wait the full 12 to 18 months to receive their inheritance.

What Happens If You Don’t Probate a Will?

In order for an estate to be opened, the executor needs to present the original will at the Register of Wills office in the county where the person died, and they must be sworn in as executor. As mentioned above, there are situations where an estate may not need to be opened. Additionally, there are times where the executor, or the person who has possession of the wills does not want to open the estate and therefore delays or avoids all together, presenting the will for probate.

If a beneficiary or creditor believes someone to have the will but is avoiding probate, they can petition the Register of Wills to compel that individual to produce the will for probate.

Probate can be a long and aggravating process. Finding a way to transfer your assets to your family without going through probate can save everyone a great deal of time and money. There are several different ways to avoid probate in Pennsylvania, including gifting, joint property, naming beneficiaries, and creating a trust.

- Gifting – One of the simplest ways to avoid probate is to gift assets before you die. Of course, gifting assets means you will no longer own them and may not have access. This is the simplest option but may not always be the most practical.

- Joint Property – Property that is owned jointly with one or more individuals will automatically pass to the other owners when one owner passes away. This can be a convenient option for spouses or other family members to pass bank accounts or real estate while avoiding probate.

- Naming Beneficiaries – Accounts that allow for a beneficiary to be named are the easiest way to avoid probate. Life Insurance, IRAs, 401ks are all accounts that should have named beneficiaries. It is essential that beneficiaries be kept up to date (i.e. death, divorce). A trust can also be named as a beneficiary if there are young children as beneficiaries of your estate.

- Creating a Trust – A trust is a legal entity that you can create to hold property as part of your estate plan. Trusts can be revocable or irrevocable. Most often, for estate planning, an individual will set up a revocable trust and act as their own trustee until they are no longer able to (death or disability). Then the successor trustee will take over managing the trust for you or your beneficiaries. For more information on how trusts work, check out our blogs on how living trusts work.

What Happens After Probate is Closed?

The probate process can be lengthy and complicated, so it can be difficult to know what happens after probate is closed. The goal of probate is to make sure that all final debts and expenses are paid, all inheritance and estate taxes are paid, and the beneficiaries receive their inheritance. Once all of the expenses, debts and taxes have been paid, the executor must provide the beneficiaries with a final accounting, which shows all of the assets and their values as wells the estates debts and expenses that were paid. Most often the executor provides an “informal accounting” which does not need to be filed with the court.

If the beneficiaries accept the accounting as provided (find out more here about what happens if the beneficiaries won’t accept the informal accounting), the executor must have all beneficiaries sign releases and the distribute the final proceeds. Once the proceeds have been distributed, the estate must file a final status report with the County Register of Wills informing them that the estate has been concluded.

How Much Does an Estate Have to be Worth to go to Probate?

The value of an estate does not determine whether or not you need to probate the estate. The types of assets are what determine if an estate needs to be opened. If a person dies with assets in their name (not joint assets and no named beneficiaries), the only way to transfer those assets is to probate the estate and become named as executor or administrator of the estate.

There are certain fees that an estate must pay such as the probate fee to the county advertising costs, and potential attorney’s fees. There may also be debts and expenses that must be paid when the estate is opened. If the assets are not valuable (small bank accounts, old cars, etc.) the asset may not even be enough to cover the expenses. You should consult with a probate attorney and review the assets before opening an estate. There are a few options for transferring some small assets without opening an estate. Read more about avoiding probate costs.

How Long Does Probate Take?

How long probate takes depends on the size and complexity of the estate, but generally an estate should take somewhere between 12 and 18 months from start to finish. It is not uncommon for an estate to take as long as two years. Selling real estate or dealing with a small business can take quite a long time.

The Pennsylvania Department of Revenue can take up to six months to process the inheritance tax return which can add to the delay in closing the estate. Final debts and expenses can usually be paid quickly as long as there is some cash available, and beneficiaries can be given partial distributions so they do not have to wait the full 12 to 18 months to receive their inheritance.

What Happens to Your Debts After You Die?

Pennsylvania state law requires that all of a person’s final debts be paid out of their estate as part of the probate process. This is not as simple as it sounds. A person’s probate estate is responsible for paying their final debts but assets that pass outside of the probate estate are not subject to those debts. If the probate estate does not have enough money to pay the debts, then the creditors should be notified that the estate is insolvent, and they will not receive payment.

If the estate has some money but not enough money to pay all the final debts and expenses, there is a specific order in which creditors should be paid. If an executor pays the wrong creditors or does not make the correct pro rata payments, they can be held personally responsible by the creditors. It is essential that you consult with an attorney before making payments of final expenses.

Do I Need to Hire a Probate Lawyer?

Often a child or family member of an individual who has recently passed away will consider tackling the estate administration process without hiring an estate attorney. Whether it is the cost of retaining counsel, or the “do-it-yourself” personality, some individuals believe that hiring a lawyer is an unnecessary expense which can easily be avoided. The truth is that there is no legal requirement to hire an estate lawyer, and there are many individuals who have successfully navigated the probate process without counsel. All too often, however, an executor will find themselves stuck, or worse yet, trying to correct a mistake that could leave them personally financially liable.

The personal representative is a fiduciary, meaning that they are held to the highest standards of loyalty and care that the law provides. Even in the most friendly and simple of estates, a personal representative can be faced with serious decisions regarding estate assets and debts. If the personal representative fails to comply with Pennsylvania estate law, or is negligent in the administration, they can be held personally liable.

There are some common elements to estate administration which are often overlooked by unrepresented individuals, which can have serious consequences.

While the do-it-yourself method can be tempting to save money, the savings in legal fees is often outweighed by the stress, potential liability, and the common mistakes and pitfalls which an executor may run in to.

1. Failing to adhere to the proper steps, practices, and procedures.

Administering an estate in Pennsylvania requires the following of very specific procedures which must be adhered to regardless of the size or type of estate. Missing a step or completing something improperly can be a serious problem. Failing to properly advertise the estate could lead to creditors filing claims long after the administration process has been completed, failing to check for a claim with the Department of Human Services, or failing to properly notify all beneficiaries are also common missteps.

2. Mistakes on the Inheritance Tax Return.

One of the largest expenses in Pennsylvania estate administration is often the Inheritance tax which ranges from 4.5% to 15%. Missing deductions, missing the pre-payment discount, or overstating the tax due can cost thousands in unnecessary expenses.

3. Mismanagement of Assets.

As the personal representative of the estate, the executor is required to marshal, secure and protect all estate assets including assets which may increase or decrease in value such as real estate or stocks. Failing to check with an insurance carrier on a now vacant home, or failing to immediately liquidate a stock before it potentially loses value, can lead to personal liability for negligence.

4. Improper Accounting.

The personal representative is required to create an accounting of all estate assets setting for the value and listing all administration expenses and valid debts of the decedent. If the accounting is not properly prepared or is incorrect, a beneficiary may raise the issue with the probate court. If the executor lacks the proper documentation for assets or expenses, he or she could face a claim for damages.

5. Failing to Secure Releases or a Family Settlement Agreement from all Beneficiaries..

Because the personal representative is potentially liable, it is essential that the beneficiaries release the executor from any liability after they have been apprised of the final estate accounting. This will protect the personal representative in the future if one of the beneficiaries decides they were unsatisfied with any part of the administration of the estate.

How Much Does a Probate Lawyer Cost?

If you’re wondering about attorneys’ fees for estate settlement in Pennsylvania, it’s worth noting that probate lawyer fees are an expense of the estate and must be paid out of estate funds (if available). Attorneys may charge an hourly rate, a flat fee, or a percentage of the estate. However, whatever the fee structure, the Pennsylvania courts require these fees to be “reasonable.”

Settling an estate as an executor can be overwhelming, particularly if you’ve never dealt with probate before. In order to complete the probate process successfully, the executor must familiarize themselves with state laws and understand their responsibilities. It’s a heavy burden to take on alone. Fortunately an experienced probate attorney can take on the bulk of responsibilities and guide the executor through the process.

Pennsylvania courts strongly encourage Executors to hire a probate attorney. An experienced Pennsylvania probate attorney will be able to guide the executor through the probate process, takes responsibility for most of the difficult tasks, and will help to ensure the executor completes all of their responsibilities.

When you need an experienced Estate Planning Lawyer contact Cherewka Law today at 717-232-4701.

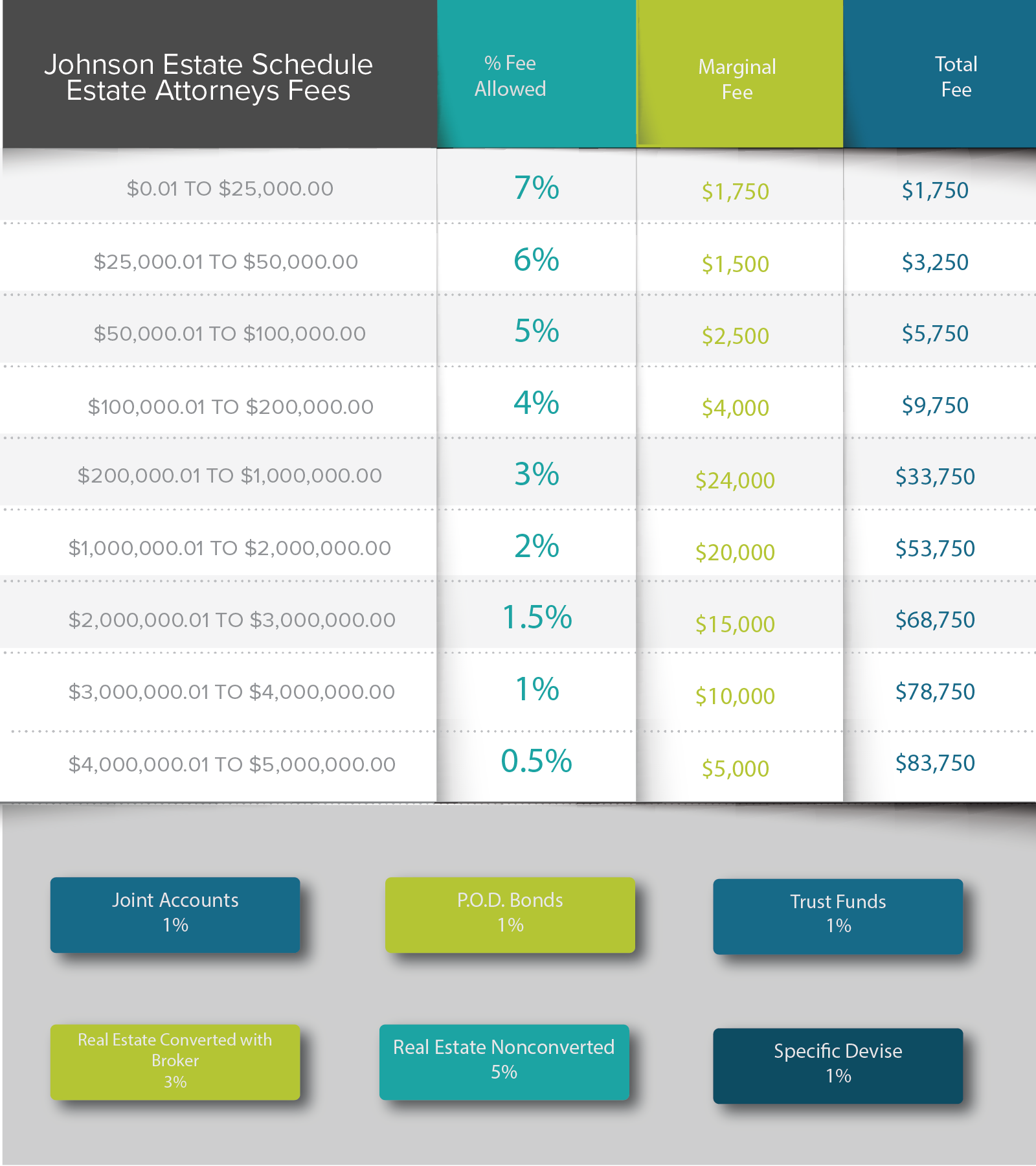

Johnson Estate Fee Schedule

The Johnson Estate executor fee schedule (included below) is a guide many courts have referenced and used as a guide since its creation 30 years ago. Rather then balancing countless factors, many judges first examine how the claimed fee compares to the schedule in Johnson. This schedule therefore serves as the most intelligible answer to an appropriate executor’s fee in Pennsylvania.

How Do I Know if the Fees are Reasonable?

There is no law or regulation in Pennsylvania which set a standard for what are “fair and reasonable” fees. Most attorneys abide by the fee schedule created by Judge Wood in the Johnson Estate, created in 1983.

This Schedule is only a starting point. When consulting with an attorney the executor should make sure the attorney is clear up front about the fee involved and the justification for that fee. Charging a percentage without justification, even if it follows the guidelines of the Johnson estate, may not be acceptable. For example, if an estate included a 2 million dollar life insurance policy, but no other assets, a $20,000 fee might be excessive. As another example a $500,000 estate which includes multiple pieces of real estate, and a closely held business which must be sold, may require more work than a 3% fee would cover.

Hourly billing is the traditional method for attorneys to charge for their services. This may seem like the best option up front, but all of the phone calls, emails, and paperwork involved in an estate can quickly add up. Often banks or insurance companies require several phone calls and emails just to secure the payment of one asset. Realtors or accountants may make daily or weekly phone calls. A small estate can quickly rack up thousands of dollars in hourly billing. Percentage or flat rate billing allows the executor to have a concrete idea of what the fees will be up front.

Whatever fee arrangement the attorney and executor agree to the engagement letter should detail what is expected of the executor and what is expected of the attorney. If the fee is a percentage or flat rate, it should be calculated based on the size of the estate, responsibility incurred by the attorney, the complexity of the estate and experience of the attorney.

Download Your Probate & Estate Administration Guide Today

Learn where you stand in your Estate Administration process. Receive a download of our most current Estate Administration Guide by filling out the form below.

"*" indicates required fields