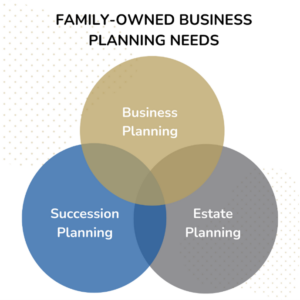

Family-owned businesses are the backbone of many economies, contributing not just to local communities but also to national growth and innovation. However, they come with unique challenges, particularly in the areas of business planning, succession planning, and estate planning. The intersection of these areas makes having a trusted attorney not just beneficial, but essential for family-owned businesses. By working with one law firm to handle all three aspects of planning, you gain efficiencies and ensure that everyone within the business and supporting the business, are on the same page.

Understanding the Overlap

Family-owned businesses often have individuals juggling multiple roles—family member, employee, and leadership or shareholder. This multifaceted dynamic creates complexities, especially when it comes to decision-making about the future. To work through these challenges, you need sound legal support in all three planning areas even though there are overlapping components:

- Business Planning: This is the foundation for any business, encompassing everything from operational strategies to financial management. Whether you’re selecting the right business entity at time of start-up or developing an exit strategy, professional guidance is paramount. However, for family businesses, business planning also involves considerations around family roles, responsibilities, and governance structures. A trusted attorney can provide valuable insights on legal compliance, corporate structure, and the intricacies of family dynamics that affect business operations.

- Succession Planning: A good business owner knows that even while you are enjoying the fruits of your labor and experiencing present-day success, the questions of “What comes next?” should never be ignored. Planning for the future of a family business is crucial, particularly in ensuring that leadership and ownership both transition smoothly. This is where a skilled attorney comes into play. A legal team can help outline a clear succession plan that defines roles, expectations, and pathways for future leaders—whether they are family members or outside hires. Attorneys can also help navigate the often-sensitive discussions that can arise around inheritance, leadership abilities, and family relationships.

- Estate Planning: Effective estate planning enables you to establish a strategy for yourself and your loved ones while retaining full control over your affairs. For business owners of family-owned business, it is essential for ensuring that the business can continue to thrive after the passing of its founder or key leaders. Attorneys like those at Cherewka Law who specialize in estate planning can help create wills and trusts that not only protect the business assets but also provide for the family’s financial future. This ensures that the business remains intact and operational, avoiding potential conflicts and disruptions.

The Role of a Trusted Attorney

In the intersection of these planning areas, the role of a trusted attorney becomes clear:

- Conflict Resolution: Family dynamics can complicate business decisions. A trusted attorney can serve as a neutral third party, helping to mediate discussions and resolve conflicts that may arise during the planning process. Their objective perspective can facilitate constructive conversations, reducing the likelihood of disputes.

- Long-Term Vision: A skilled attorney can help you envision the long-term future of your business. They can assist in creating a strategic plan that aligns with both your business goals and your family’s values, ensuring that both can thrive together.

- Risk Mitigation: Family-owned businesses face unique legal risks, from personal liability to tax implications. An experienced attorney can identify these risks and implement strategies to mitigate them, helping to safeguard both the family and the business.

The complexities of family-owned businesses necessitate a multifaceted approach to growth and legal guidance. With the right attorney by your side, you can tackle everything from business planning to succession and estate planning with confidence.

At Cherewka Law, we believe in working together as a team and making sure that the needs of you, your family, and your business are all top of mind. Taking the time to plan today will ensure your family business thrives for generations to come.