Summary of CTA Due Dates

We are writing with a mid-year update on the Corporate Transparency Act (the “CTA”). Our summary of the CTA issued earlier this year can be viewed by clicking here.

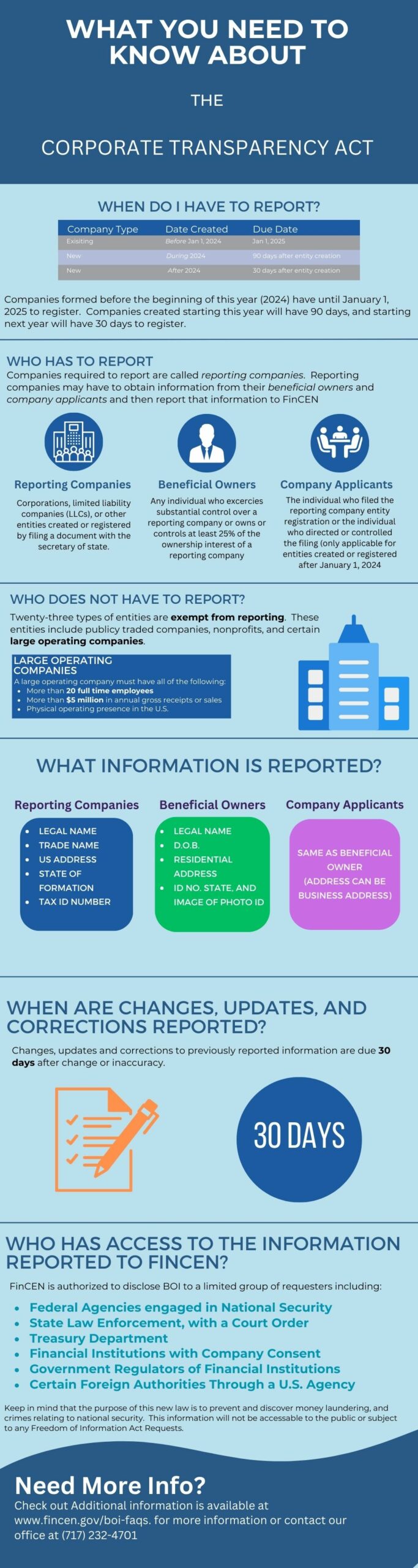

As you are likely aware, the CTA’s new requirements are being phased in during 2024 and 2025, and we expect changes and interpretations will occur regularly over the next 18 months or so.

The first reporting requirements have already started in 2024, for any entity (corporations, LLCs, etc.) that is formed during 2024. For entities that have been or are formed in 2024, the initial CTA filing is due within ninety (90) days of the entity organization date.

We have been assisting our clients who have formed entities during 2024 in meeting their CTA requirements.

The next due date will be at the end of 2024 (technically on or before January 1, 2025) and will apply to all entities that were formed prior to January 1, 2024 (unless a very limited exemption applies).

Litigation Updates

Several groups have filed lawsuits in federal courts across the country challenging the CTA on several grounds, mostly centered on the constitutionality of the act and on the authority of Congress to pass this type of statute. On March 1, 2024, a U.S. District Court in Alabama ruled the CTA unconstitutional in its entirety. Currently, that ruling only applies to the named plaintiff (the National Small Business Association and its members).

There have been no rulings in any of the other filed lawsuits, and the United States has appealed the Alabama District Court ruling to the Eleventh Circuit Court of Appeals.

FinCEN has stated that all other entities across the country must comply with the CTA requirements on a timely basis. So what does this mean for you as a business owner?

First, if you have organized a new entity in 2024, or plan to organize such an entity during the rest of this year, you are required to file your initial CTA report within 90 days of filing your organization documents (Articles of Incorporation, Certificate of Organization of LLC, etc.).

Second, if you created your entity or entities prior to January 1, 2024, there has been NO indication from FinCEN that it plans to extend the January 1, 2025 deadline. And while both the United States and the National Small Business Association have joined in asking the 11th Circuit to expedite the appeal of the Alabama case due to the impending January 1, 2025 filing deadline, there has been no indication by that Court of how soon it might issue a ruling or what the ruling might be.

Dissolutions During 2024

FinCEN has recently released updated FAQs concerning entities that are dissolved during 2024. The first release concerns entities that were in existence prior to January 1, 2024, but that were dissolved during 2024. FinCEN’s position is that such entities still must file their report on or before January 1, 2025 regardless of whether it is dissolved prior to the deadline.

The second update concerning dissolved entities is that if a new entity is formed during 2024, and then decides to dissolve within ninety (90) days of its formation, such entity still must file its initial CTA report

What’s next?

Since FinCEN has not indicated any intent to extend the January 1, 2025 deadline, and the 11th Circuit Court of Appeals has given no indication of either the timing of its decision or what that decision might be, we are expecting that a large number of companies will be submitting their CTA filings in the final quarter of this year. Indeed, we expect a lot of companies will hold off such filings until December with the hope that the 11th Circuit will dismiss the government’s appeal –or that FinCEN will extend the January 1, 2025 deadline until after the appeal is decided.

We will be in contact with our existing business clients to remind you of this pending deadline, and to assist you in preparing and filing the required CTA filing.

If you are not an existing business client, but would like our assistance in preparing and filing your CTA report, we do request that you contact us prior to November 1, 2024 so that we can confirm your engagement for such services and to be able to gather your required information on a timely basis to meet the current filing deadlines.